How common is "common knowledge"?

An old friend observed that Zoltan Pozar’s recent claim that “60/40 won’t cut it anymore and should be 20/40/20/20 instead” is spurious.

Nobody believes in 60/40 anymore, he said.

I wondered: while the idea that investors should balance their portfolios 60% equities and 40% bonds certainly took a beating in 2022—”is the 60/40 dead? Goldman asked—is it true that “nobody believes” in 60/40?

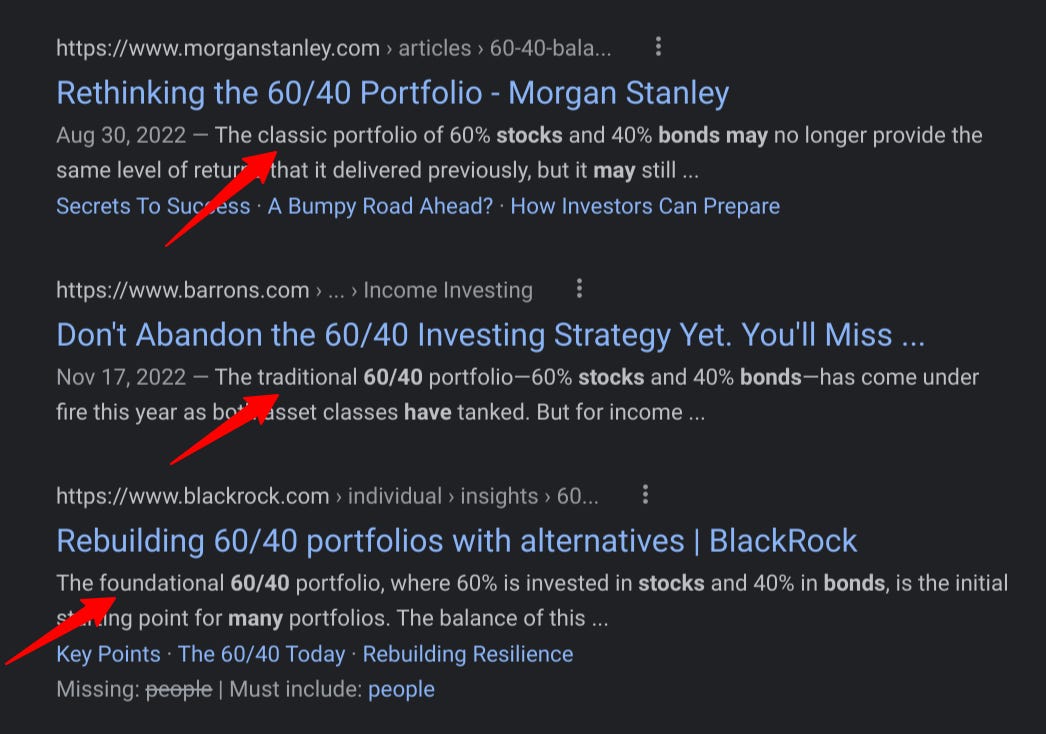

I decided to Google and asked “how many people use 60/40 for equities to bonds?”

Google wouldn’t tell me how common the strategy is, BUT search results suggest that “everyone” (at least Morgan Stanley, Barrons and BlackRock) agrees that 60/40 is “classic,” “traditional,” or “foundational.”

The Goldman report observes unhelpfully, “although most investors typically don’t hold such a simplistic portfolio, we see shades of the classic 60/40 present in many portfolios due to an overconcentration in the most familiar asset classes.” Shades present in many portfolios… thanks Goldman!

So who knows how many investors use the strategy? (Googling “how many investors weight their portfolios 60/40 equities to bonds?” doesn’t yield any more concrete or specific answers.)

So we really don’t have any idea how common this “common” strategy actually is.

The difficulty of answering the question “how common is a given nugget of common knowledge” is constant in markets. Who knows what and how well is that information discounted by prices?

At any given moment, we can glimpse what market participants are doing, but nobody has much of a clue what everyone else is actually doing, either individually or in aggregate. (Is your selling intended to set a short, or are you blowing out a long? How long have you been building a position? What offsetting positions do you have?)

Any “consensus” is a mirage. We all live in bubbles of like-minded investors, and aren’t quite sure how many other people share our unconscious biases, explicit premises or financial positions. Or how much our guesses or judgments are already discounted in prices. To put it another way, predicting the future is hard, but it’s even harder to predict how everyone’s positions discount (or ignore) that future. And, worst of all, how those positions will themselves impact that future.

What does this have to do with Twiangulate? Subscribe to watch us figure it out.